But You’ll Have to Ask the Right Questions to Get Profitable Answers

The world’s most precious resource is no longer found beneath the Earth’s surface but is instead all around us. It’s data, and it permeates everything we do.

Data is widely considered the “new oil” that will drive growth and change in the new millennium. Like oil before it, data has the power to transform business and industry. In fact, companies that embrace a data-driven strategy are growing around 30 percent annually to boost their businesses, according to Forrester Consulting. It’s no surprise companies are investing significant time, money, and resources in data. Sixty-seven percent (67%) of B2B firms sites increased innovation in Anti-Money laundering Compliance with the help of using data and analytics as a critical priority over the next 12 months, according to a new study conducted by Forrester Consulting on behalf of Dun & Bradstreet.

While crude oil is scarce and often hard to extract, data has become the most bountiful resource of the 21st century. But is that really a good thing?

The fact is that data is only as good as the insights derived from it. Data alone doesn’t tell a story. In the same way that oil is just thick, sticky goop until it is refined into fuel and other useful chemicals, data is just noise unless it is structured, analyzed, and used to answer the right questions. Companies are clamoring to get as much data as possible but aren’t thinking much about the right way to use it. And unfortunately, this means data is often treated like common gravel rather than the precious gems it ought to be.

Too Much of a Good Thing?

The explosion of data is creating just as many challenges as it is opportunities. Propelled by the digitization of business, companies are awash in data. Every day, we produce more data than the previous one – at a rate that’s arguably impossible to measure or model, because we’ve lost the ability to keep pace with data’s rapidly changing nature.

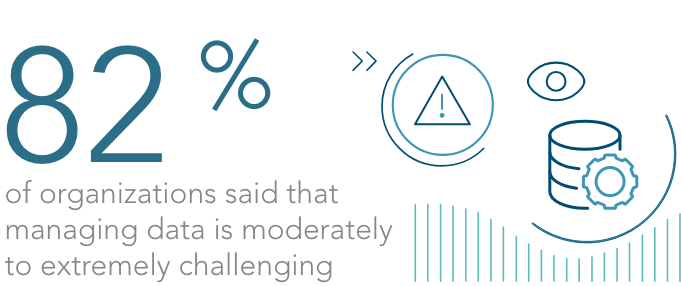

Think about the data that you have at hand. It’s often poorly organized, living in disparate databases and multiple systems within a single organization. And then there’s the issue of legitimacy. How accurate is the information being collected? Is it based on fact or fiction? It’s no wonder 82 percent of organizations said, according to the Forrester report, that managing the volume, variety, and velocity of data is “moderately to extremely challenging.”

As more companies look to data to gain a competitive advantage, turning that information into valuable insight is becoming more difficult. The ability to drive meaningful growth can only be realized when you are able to extract real insights – truth and meaning – from the right data.

For those organizations getting it right – the ones who are effectively organizing, managing, analyzing, and activating their data – data is proving to be a valuable commodity that’s accelerating the pace of innovation and transforming the status quo. When companies bring relevant data into the rhythm of the business, they’re able to establish a single, trusted view of their customers, prospects, and partners – those relationships that ultimately impact every aspect of the business. By doing so, they’re improving business performance in key areas such as growth, customer satisfaction, and efficiency.

According to the Forrester report, data activation leaders – those with above-average scores across the 15 competency areas of the survey – were more likely to report increases in the following key metrics:

- 77 percent customer retention/loyalty

- 73 percent sales cycle speed

- 73 percent return on marketing spend

But achieving similar results is no easy task. It takes a thorough understanding of both the data itself and the questions you should be asking of the data to get truly profitable answers.

Asking the Right Questions of Your Data

Every company faces a unique set of business challenges, and data can often help address many of them. Some of that data may reside in-house within your own databases, and some of it may be obtained from third parties. However, not all data is going to put you on the path to success. Successful organizations are able to recognize the importance of data that provides meaning or context for specific goals.

There are many ways data can drive value in a business setting. Understanding the right questions to ask of the data can help you gain a leg up on your competitors. The questions can and should run across every area of the business. Here’s an idea of some of the questions that can be answered with the right data.

Data to Drive Revenue

- How can we get more out of our existing marketing programs?

- How can we deliver more qualified leads?

- How can we improve our close rates?

- How can we consistently interact with customers and prospects across the buyer’s journey?

Data to Reduce Costs

- How can we optimize cash flow?

- How can we automate credit decisions?

- How do we make sure our suppliers don’t ruin the financial results?

- How can we improve operating efficiency across the board?

Data to Transform the Business

- How can we support digital transformation?

- How can we create a single view of all of our key relationships?

- How can we unify data across all our applications?

- How can we leverage data to support innovation across the enterprise?

Data to Manage Risk

- How can we avoid costly compliance penalties?

- How can we keep our company from litigation and fines?

- How can we ensure our suppliers are ethical and compliant?

Going Deeper With What Data Can Reveal

As more businesses point to smart data as a conduit to growth, asking the right questions of your data in order to extract meaningful insights will ultimately propel your business. That means going beneath the surface of what you normally see and exploring your business relationships to fully understand the cause and effect in your very own ecosystem.

All too often, companies think of data myopically. Sure, there’s the data we’re all familiar with: the customer data, firmographics, the foundational information about a person, place, or thing. But data goes far deeper. With the help of the right structure and analytics and, again, by asking the right questions, data can help expose information you may not be aware of. You just need to know where to look.

In some cases, a surface understanding of a company may be sufficient to address your business objectives, but in other instances, you need deeper insight. Driving down to explore the layers that inform connections between business entities, you’ll discover connections and associations that can help inform more prudent and informed decisions that can impact your approach toward pricing, terms, risk, and more. Everything from trade data to shipping data to public legal documents and even to knowing ultimate beneficial ownership enables you to interpret signals that create meaningful insights into your daily business dealings.

Turning Information Into Insight

When you’re able to identify the right data, it can work in harmony across every department. Take a look at a few examples of the power of good data. It lets you infer risk and opportunity by integrating, synthesizing, and discovering insights across multiple sources, which provides a deeper understanding of entities you may wish to do business with.

For Finance

Scenario:

A current customer is asking for extended credit.

Data Owned by Lender:

- Customer purchase volume history

- Customer invoice payment history

Third-Party Data on Customer:

- Management team turnover

- Trade history

- Credit enquiries

- Rumored M&A activity

Inferences made from analyzing the data:

This company may be experiencing a down period and is seeking to extend their credit and payment schedules to get through a rough patch. You may want to not only reject their request for an increased credit limit but also consider COD for large deliveries.

For Sales and Marketing

Scenario:

A networking company seeking to acquire new customers.

Data Owned by Networking Company:

- Prospects visiting your website

- Prospects participating in marketing campaigns (e.g., events, emails, etc.)

Third-Party Data on Prospects

- New credit inquiries

- Social media posts on talent scouting

- Real estate inquiries

Inferences made from analyzing the data:

These data sets may signal a prospect’s intention to move into a new location. Subsequently, the prospect may require additional networking equipment. Leveraging signal data plus customer data recommends prospect becomes a prioritized target.

For Supply

An organization wants to ensure they have a fully transparent supply chain for all their business needs.

Data Owned by Company:

- Supplier information gathered through assessments and onboarding process

- Contractual data

- Firmographic data

Third-Party Data on Customer:

- Family lineage

- Financial insolvency

- Debarment information

- Country risk, geopolitical concerns

Inferences made from analyzing the data:

Based on information provided by Dun & Bradstreet, the consumer-packaged goods (CPG) company has a more robust view of their potential new supplier, including financial solvency and their responsible business practices, including debarment and human-trafficking risk data. This information will help the CPG company understand if the supplier is at risk for being able to deliver or is violating the CPG company’s code of supplier conduct. A decision whether to onboard them can now be made based on more than just the basic information provided during supplier discovery.

The ability to turn your data into the kind of intelligence that drives real-world impact is not easy, but it’s very possible. Companies that are asking the right questions of their data are seeing increases in performance. You can too – you just need to know where to begin.

4 Data-Inspired Questions You Need to Ask Before Data Can Start Driving Performance

- What is the state of your data today? Do you have an enterprise-wide strategy for collecting and organizing your data?

- Do you understand the business hierarchies of your customers, suppliers, and partners in order to identify opportunities from the interconnected business relationships across the enterprise?

- Do you have relevant and structured data to provide the organization with an accurate view of your relationships?

- Are you working with the most up-to-date data possible?

You can learn more about Dun & Bradstreet’s Data Cloud and how it can help you on your own path to driving better performance.