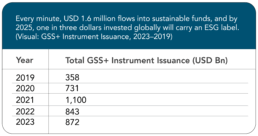

Environmental, Social, and Governance (ESG) finance has moved from the margins to the mainstream. What began nearly two decades ago with the world’s first green bond has grown into a USD 3 trillion global force, reshaping capital allocation and investment strategy. Yet beneath the optimism lies a sharp imbalance. While developed markets continue to dominate sustainable finance, emerging economies face an annual ESG funding gap of USD 3.7 trillion, the amount needed to meet the UN Sustainable Development Goals (SDGs) by 2030.

For these economies, the shortfall is a structural risk to growth and resilience. Closing it requires more than capital. It demands the right mix of policy coherence, regulatory alignment, and innovation.

Europe continues to lead with USD 405 billion raised in 2023 alone, supported by carbon pricing, strong disclosure norms, and institutional demand. Asia-Pacific and North America follow at a distance, while Africa accounts for less than 1 percent of global green-bond issuances.

This divide underscores a key point: ESG funding is not merely financial, it reflects the maturity of governance, policy, and data ecosystems that enable trust and transparency.

Emerging economies, though producing 60 percent of global GDP and 75 percent of carbon emissions, remain on the sidelines of this transformation. Limited access to affordable capital, weak disclosure standards, and fragmented regulation deter both investors and domestic institutions from scaling sustainable finance.

Momentum in Motion: How Emerging Markets Are Catching Up

Saudi Arabia is using its Green Financing Framework to channel capital toward low-carbon projects, while Thailand launched Asia’s first sovereign Sustainability-Linked Bond in 2024. In South Africa, the Just Energy Transition Partnership is driving coal-to-renewables investment, backed by USD 5.1 billion in EU commitments.

Together, these examples illustrate a shift as emerging markets are actively redesigning their investment frameworks to attract ESG capital. The growing diversity of instruments, from sustainability-linked bonds to biodiversity bonds, signals that financial innovation is beginning to match policy ambition.

Policy Alignment: The Next Competitive Edge

Regulation remains the single most decisive factor in ESG adoption.

(Visual: ESG Regulations and Taxonomies Across Key Markets)

This comparison highlights a widening maturity gap. Advanced emerging economies like China and India are moving toward standardized disclosure and fund alignment, while others still rely on voluntary frameworks. For investors, inconsistency translates to higher risk premiums and reduced appetite for cross-border ESG exposure.

Building taxonomy interoperability, where national classifications align with global standards, can reduce compliance complexity and boost investor confidence. Paired with data transparency and technology-enabled verification, this alignment can unlock scale.

Turning Barriers into Catalysts

Bridging the ESG funding divide requires shifting perspective. Instead of viewing regulation, reporting, or capital cost as obstacles, emerging economies can treat them as catalysts for systemic reform.

Several trends point the way forward:

- Harmonize global and local standards. Align ESG taxonomies with domestic priorities to balance investor expectations with national growth needs.

- Build blended-finance mechanisms. Combine concessional, sovereign, and private capital to de-risk early projects.

- Invest in skills and data. ESG literacy and transparent reporting are the foundations of investor trust.

- Engage banks and corporates. Domestic institutions can mainstream sustainability by embedding ESG risk into credit, procurement, and governance.

When paired with digital verification and cross-border cooperation, these measures can turn ESG finance from an external requirement into a domestic growth engine.

The Road Ahead

The ESG opportunity for emerging markets is both urgent and immense. With climate impacts intensifying and investors demanding accountability, the next phase of sustainable finance will hinge on one thing: credible ecosystems that connect purpose with profitability.

For policymakers and business leaders, the path forward is clear, align standards, strengthen governance, and innovate finance.

For investors, the message is equally direct: the most transformative returns will come from where the funding gaps are widest.

Read the full Dun & Bradstreet report, “ESG Funding in Emerging Markets,

to explore how data, regulation, and innovation can accelerate sustainable capital flows across South Asia, the Middle East, and Africa.