The Middle East and North Africa (MENA) region is navigating a world of shifting trade dynamics, staggered global growth, and heightened uncertainty. While tariff regimes and energy price volatility create new challenges, the region is also advancing with non-oil momentum, capital inflows, and ambitious diversification programs. Dun & Bradstreet’s Quarterly Global Economic Outlook Q3 2025 highlights both the risks and opportunities defining MENA’s economic trajectory into the second half of the year.

The Middle East and North Africa (MENA) region is navigating a world of shifting trade dynamics, staggered global growth, and heightened uncertainty. While tariff regimes and energy price volatility create new challenges, the region is also advancing with non-oil momentum, capital inflows, and ambitious diversification programs. Dun & Bradstreet’s Quarterly Global Economic Outlook Q3 2025 highlights both the risks and opportunities defining MENA’s economic trajectory into the second half of the year.

Trade Pressures and Tariff Exposure

One of the most immediate challenges facing MENA economies is the impact of Washington’s expanding tariff regime. New baseline duties apply to Gulf states, while countries such as Iraq, Tunisia, and Syria face steeper rates of up to 41%.

Oil and gas exports remain exempt from these measures, offering some insulation for hydrocarbon dependent economies. Non-energy exports (chemicals, fertilizers, and textiles), however, now face rising costs, increasing pressure on trade competitiveness. For Gulf economies, hydrocarbon surpluses provide a buffer. But for countries such as Jordan and Tunisia, where domestic safety nets are weaker, tariff exposure risks amplifying fiscal and industrial vulnerabilities.

For businesses, the lesson is clear: trade flows are not static. Companies operating in or trading with MENA must reassess supply chains, monitor cost structures, and prepare for more volatility in cross-border transactions.

Oil Prices and Energy Outlook

Energy remains central to the MENA story, but oil’s role is evolving. After a brief spike earlier this year, prices slipped back below USD 70 per barrel, even as OPEC+ raised production for the third consecutive month, adding 411,000 barrels per day in July.

For major producers such as Saudi Arabia, the UAE, and Iraq, lower oil prices temper revenue expectations. However, these economies retain fiscal resilience, enabling them to cushion against short term volatility.

Oil’s volatility, though, is a reminder of how quickly energy-linked risks spill into broader macroeconomic conditions. Shifts in oil markets continue to influence inflation dynamics, investor confidence, and fiscal room for maneuver, both within the region and globally.

Non-oil Growth and Investment Momentum

Perhaps the most notable development in MENA’s outlook is the rapid expansion of non-oil sectors. Investment activity is accelerating, and venture capital funding surged 58% year-on-year in Q1 2025, led by fintech, edtech, and e-commerce. Saudi Arabia and the UAE dominate this deal flow, supported by infrastructure programs and diversification strategies.

This signals a structural pivot as MENA is no longer just a story of hydrocarbons but increasingly one of digital transformation, entrepreneurship, and sustainable growth.

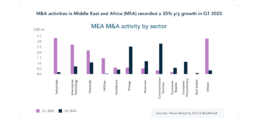

M&A activity in the Middle East and Africa grew 35% y/y in Q1 2025, with non-oil sectors such as technology and consumer services attracting strong deal flow.

Beyond venture capital, M&A activity across the Middle East and Africa rose 35% year-on-year in Q1 2025, underscoring confidence in the region’s diversification agenda. While deal making remains concentrated in Saudi Arabia and the UAE, new growth nodes are emerging across other markets, expanding the map of opportunity.

Business Sentiment and Risk Environment

Despite strong investment pipelines, businesses remain cautious. According to Dun & Bradstreet’s Global Business Optimism Insights, the Global Business Optimism Index fell 6.5% quarter-on-quarter in Q3 2025. Tariff uncertainty and weaker sales weighed heavily on outlooks, particularly in trade-linked sectors such as metals, chemicals, and automotives.

This underscores a paradox, as capital is flowing in but sentiment is weakening. The divergence highlights the need for businesses to build optionality, flexibility in strategy, financing, and supplier relationships, as a hedge against global uncertainty.

ESG as a Strategic Imperative

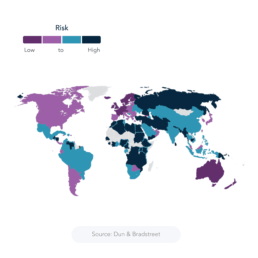

Sustainability is increasingly intertwined with trade policy. Dun & Bradstreet’s Country ESG Ratings show elevated risks in parts of MENA linked to governance, climate, and quality of life. At the same time, tariffs are forcing companies globally to integrate trade considerations into their ESG frameworks.

Dun & Bradstreet’s Country ESG Ratings reveal higher pockets of risk across MENA, reinforcing the importance of integrating sustainability into supplier selection and investment strategies.

For companies sourcing from or operating in MENA, this presents both a challenge and an opportunity. On the one hand, aligning operations with global ESG standards is becoming more complex as regulations tighten. On the other, businesses that embed ESG into supplier selection and risk controls can differentiate themselves and strengthen long-term competitiveness.

Global Risks With Regional Implications

MENA’s outlook cannot be separated from global headwinds. Dun & Bradstreet’s Q3 analysis highlights five downside risks shaping the global environment, all of which have implications for MENA:

Escalating trade tensions that disrupt cross-border investment flows.

Export-driven vulnerabilities in economies tied to shifting global demand.

Energy security concerns, underscored by volatility around strategic shipping routes.

Persistent inflation and divergent monetary policies, fueling capital flow volatility.

Political fragmentation reducing predictability in global institutions and trade rules.

For MENA, these global dynamics reinforce the urgency of diversifying growth drivers and embedding resilience into economic strategies.

Building Resilience Through Optionality

Looking ahead, MENA’s challenge is balancing external risks with internal momentum.Tariffs and oil price swings create vulnerabilities. However, rising non-oil investment, accelerating deal flow, and ambitious diversification agendas present strong counterweights.

For businesses, this means:

Reassessing supply chains in light of tariff exposure.

Engaging with fast-growing non-oil sectors such as fintech, edtech, and e-commerce.

Integrating ESG and trade risks into sourcing and investment strategies.

Maintaining flexibility to pivot quickly as global conditions evolve.

At Dun & Bradstreet, we believe resilience in today’s economy is built on optionality. Companies that embrace diversification, leverage risk intelligence, and align with long-term sustainability will be best positioned to thrive in the region’s next chapter.