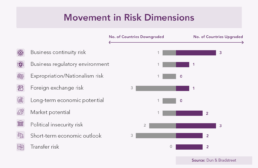

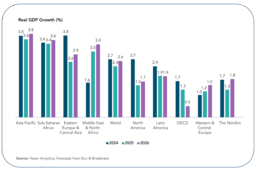

Global markets are navigating a turbulent second half of 2025, as new U.S. tariffs, sanctions, and uneven demand weigh on growth. For businesses across South Asia, the Middle East, and Africa, the picture is mixed: stress points in finance and politics on one hand, and signs of resilience and diversification on the other.

Economic Pulse Updates Across Regions

For South Asia, the Middle East, and Africa, the story is one of divergence. Fragile banking systems and fiscal strain weigh on some economies, while others benefit from tourism and diversification efforts. Regional dynamics are proving decisive in shaping the outlook, underscoring why businesses must monitor local signals as closely as global ones.

Economic Pulse: South Asia

Bangladesh

Credit growth has slowed to a record low of 6.4%, while non-performing loans have climbed above 20%, raising concerns about banking stability. Aid inflows are also declining, compounding pressure on the external account.

Sri Lanka

Food prices have eased, with the Colombo CPI cooling in July, offering some relief from inflationary strain.

Nepal

Wholesale inflation fell to 1.56% y/y, reflecting softer intermediate goods prices.

Bhutan

GDP expanded by 5.7% in Q1 2025, supported by high-spending non-Indian tourism.

Maldives

Posted 2.5% growth in Q1, led by tourism and construction, though the fiscal deficit widened, leaving the government reliant on foreign borrowing.

Takeaway: South Asia’s growth remains uneven, with smaller economies showing resilience in tourism but weighed down by fragile banking sectors and fiscal imbalances.

Economic Pulse: Middle East & North Africa

- U.S. tariffs on MENA exports range from 15%-41%, with Algeria, Libya, Syria, Iraq, and Tunisia facing the steepest rates.

- The U.S. has imposed its largest sanctions package on Iran since 2018, targeting over 115 entities and vessels, complicating the prospects for nuclear negotiations.

- OPEC+ output is rising in Saudi Arabia, the UAE, and Algeria, but weaker global demand risks keeping oil prices subdued despite brief spikes.

- Saudi Arabia continues to attract new investment: 83 industrial licenses in June brought in USD 253m and 1,188 jobs, while new factories added USD 506m and 2,007 jobs.

- GCC venture capital activity surged 58% y/y in Q1 2025 to USD 678m, alongside major data-center and private equity deals.

Takeaway: MENA’s economic resilience hinges on accelerating diversification even as oil volatility and U.S. sanctions create fresh headwinds.

Economic Pulse: Sub-Saharan Africa

DRC

The Democratic Republic of Congo (DRC) signed a truce with M23 rebels in July, but violence has persisted, especially in mineral-rich Ituri Province.

Kenya

Kenya is facing violent anti-government protests over corruption and the cost of living, creating uncertainty for investors.

Tanzania

Tanzania saw tourism revenue of USD 3.92bn in May, surpassing gold export earnings of USD 3.83bn, a milestone that highlights tourism’s growing role in FX earnings.

South African

The U.S. is weighing sanctions on South African officials over ties with Russia and China, adding new layers of risk to its investment climate.

For SAME economies, 2025 is defined by external pressures, tariffs, sanctions, and political volatility, but also by opportunities. Gulf diversification, South Asian tourism, and African services are bright spots. Businesses that can hedge risks, diversify exposure, and align with regional policy shifts will be better positioned to withstand global turbulence.

Manually Vetting Vendors? Save Time, Reduce Risk, & Stay Compliant

Dun & Bradstreet’s Vend-R platform delivers verified, risk-rated vendor profiles in one place, cutting vetting time, supporting compliance standards, and helping you avoid exposure to unreliable or noncompliant suppliers.

A clearly defined vendor selection process helps corporations reduce uncertainty and make informed, high stakes decisions with confidence. By following these key steps, from defining business needs to onboarding and monitoring, organizations can ensure that each vendor relationship is built on a foundation of due diligence, strategic fit, and long term value. In the next blog, we’ll explore how to optimize these processes further by embedding best practices that improve efficiency, compliance, and performance across the procurement lifecycle.